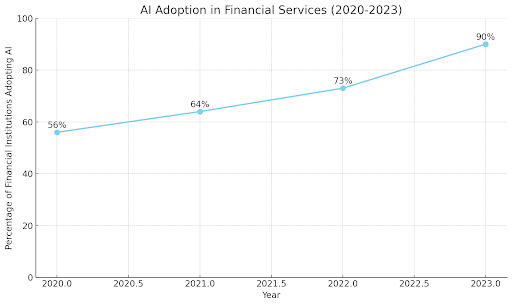

Artificial Intelligence (AI) is driving a monumental shift across various industries, and the financial services sector is no exception. With its ability to analyze vast amounts of data, predict trends, and automate complex processes, AI is enhancing efficiency, security, and customer experiences in unprecedented ways. Financial institutions, from banks to insurance companies, are leveraging AI to streamline operations, reduce fraud, improve customer service, and offer personalized services.

This transformation is not just about adopting new technology but fundamentally reshaping how financial services are delivered and experienced. Here, we explore the key areas where AI is making a significant impact, supported by real-time examples that highlight its revolutionary role in the financial services industry.

AI is transforming banking by offering a more personalized experience for customers. By analyzing vast amounts of data, such as transaction histories, spending habits, and even social media activity, AI can create detailed profiles of customers.

This allows banks to tailor their services and products to meet individual needs more accurately. For example, if a customer frequently travels, AI can recommend a travel-friendly credit card with benefits like air miles or no foreign transaction fees. This level of personalization helps in building stronger customer relationships and enhances overall satisfaction.

AI uses vast amounts of data to understand individual customer behaviors and preferences. Here’s how it works:

HDFC Bank’s EVA chatbot is a great example of this. EVA handles over 2.7 million queries from more than a million customers, offering instant responses and tailored advice based on individual customer needs.

Fraud detection has always been a major concern for financial institutions. AI revolutionizes this area by utilizing advanced algorithms to detect unusual patterns and behaviors that may indicate fraudulent activity.

Unlike traditional methods, which often rely on predefined rules, AI can adapt and learn from new data, making it more effective at identifying new types of fraud. Real-time monitoring enables immediate response to suspicious activities, thereby preventing potential losses and ensuring customer trust.

AI systems are incredibly effective at spotting fraudulent activities because they can analyze large datasets quickly and accurately. Here’s the process:

ICICI Bank uses an advanced AI system to monitor transactions in real-time. In 2019, this system helped prevent fraudulent transactions worth millions of rupees, protecting both the bank and its customers from significant financial losses.

Traditional credit scoring methods often exclude many individuals who do not have a substantial credit history. AI addresses this issue by considering alternative data sources such as payment histories for utilities, rent, and even social media behavior.

This provides a more comprehensive assessment of an individual’s creditworthiness, making the system fairer and more inclusive. As a result, more people, especially those new to credit or with non-traditional financial backgrounds, can access loans and financial products.

Traditional credit scoring methods often rely on a limited set of data, which can be unfair to individuals without a robust credit history. AI changes this by:

LenddoEFL, an AI-based credit scoring platform, uses non-traditional data like social media activity and smartphone usage to evaluate creditworthiness. This approach has enabled many individuals in India to access loans and improve their financial status, even without a traditional credit history.

Investing can be complex and intimidating for many. AI-powered robo-advisors simplify this process by providing personalized investment advice based on individual goals, risk tolerance, and financial situation.

These digital advisors use sophisticated algorithms to create and manage diversified portfolios, continuously adjusting them to align with market conditions and personal objectives. The affordability and accessibility of robo-advisors make high-quality investment advice available to a broader audience, democratizing financial planning.

Robo-advisors use algorithms to provide personalized investment advice. Here’s how they operate:

Take 5Paisa, an Indian discount broker, which offers an AI-powered robo-advisory service providing customized investment recommendations. This service has democratized access to financial advice, allowing more people to invest wisely and confidently.

Routine tasks such as document verification, transaction processing, and customer onboarding can be time-consuming and prone to errors when handled manually. AI automates these processes, significantly reducing the time and effort required.

For instance, AI can quickly verify customer documents during the account opening process, ensuring compliance and reducing the risk of human error. This automation not only enhances efficiency but also allows bank employees to focus on more complex and value-added activities.

AI can take over repetitive and time-consuming tasks, freeing up human employees to focus on more complex issues. Here’s how this automation benefits financial services:

YES BANK uses AI to automate processes like loan disbursement and customer onboarding. This automation speeds up operations and improves accuracy, providing a better overall experience for customers.

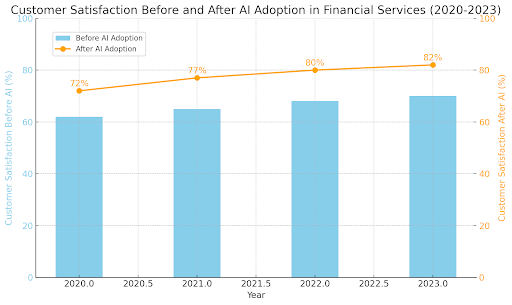

AI-driven customer service tools, such as chatbots, have become integral to providing timely and accurate support. These tools can handle a wide range of customer queries, offering instant responses and solutions around the clock.

By analyzing customer feedback and interactions, AI can also provide insights into customer sentiments and areas for service improvement. This continuous availability and responsiveness enhance the customer experience, making it more convenient and satisfactory.

AI-driven customer service tools ensure that customers receive timely and accurate assistance. Here’s how:

HDFC Bank’s EVA chatbot, which provides 24/7 customer support and handles millions of queries efficiently, is a great example. This not only improves customer satisfaction but also frees up human agents to handle more complex issues.

AI enables financial institutions to gather and analyze real-time data, providing valuable insights that inform better decision-making. By tracking market trends, customer behaviors, and potential risks, AI helps banks stay competitive and proactive.

These insights allow for the development of more relevant and targeted financial products, improving customer satisfaction and business performance. Moreover, AI’s predictive capabilities help in anticipating market changes and preparing for potential challenges.

AI’s ability to analyze large datasets in real-time offers several advantages:

ICICI Bank uses AI-driven analytics to gain insights into customer behavior and market trends. This enables the bank to offer better products and services, improving customer satisfaction and business outcomes.

AI is revolutionizing the financial services industry in many ways. From personalized banking experiences to enhanced fraud detection and improved customer service, the impact of AI is undeniable. As AI continues to evolve, we can expect even more innovations in the financial sector, making it more efficient and customer-friendly. So, the next time you interact with your bank, remember that AI is working behind the scenes to make your experience better.

Artificial Intelligence Insights and Trends