In the fintech industry, user experience is everything.

Whether you’re handling a stock trade, processing a payment, or showing a balance update—real-time performance is non-negotiable. Customers expect instant, secure, and seamless digital experiences. If your app lags, crashes, or takes too long to update, you’re not just risking churn—you’re risking credibility.

This pressure has led many fintech startups to rethink the tech stacks they rely on. And one stack, in particular, is standing out: the MEAN stack—MongoDB, Express.js, Angular, and Node.js.

It’s not just a tech trend. It’s a strategic choice.

Many early-stage fintech companies still rely on older backend systems like LAMP (Linux, Apache, MySQL, PHP) or separate frontend/backend stacks that require different languages.

But here’s what typically goes wrong:

In a market that moves fast, these delays are dangerous.

That’s why the MEAN stack is becoming the go-to choice for fintech startups building real-time financial applications.

The MEAN stack is a full JavaScript-based technology stack used to develop dynamic and scalable web applications. It stands for:

Each of these technologies plays a unique role in making MEAN one of the most efficient and scalable stacks for real-time fintech app development.

This is where MEAN beats most alternatives.

Instead of managing 3–4 different languages across the stack, MEAN allows developers to write everything in JavaScript—from client-side interfaces to server logic to database interactions.

Benefits:

Node.js is the heart of MEAN’s backend.

It uses a non-blocking, event-driven architecture, which means it doesn’t wait around for one task to finish before starting another. This makes it ideal for applications that require high concurrency, like trading dashboards or payment gateways.

Example Use Cases:

Why it matters for fintech:

Financial data isn’t static. It changes shape and complexity over time.

One month, you may want to store basic transaction info. The next, you might need metadata for compliance audits, additional tags, geolocation data, or event logs. MongoDB allows you to adapt fast.

MongoDB’s Advantages:

Why fintech loves it:

Frontend matters just as much as backend in fintech. Trust is built through the interface.

Angular is an enterprise-grade frontend framework with built-in modules for routing, state management, animations, and forms.

In fintech, Angular enables:

Compared to alternatives:

Express handles routing and middleware with minimal configuration. It allows you to create REST APIs that connect Angular with backend logic seamlessly.

Security is key here:

Let’s say you’re building an app that lets users:

With MEAN stack:

By the end, you have a fully functional, scalable MVP—ready to raise funding or enter beta.

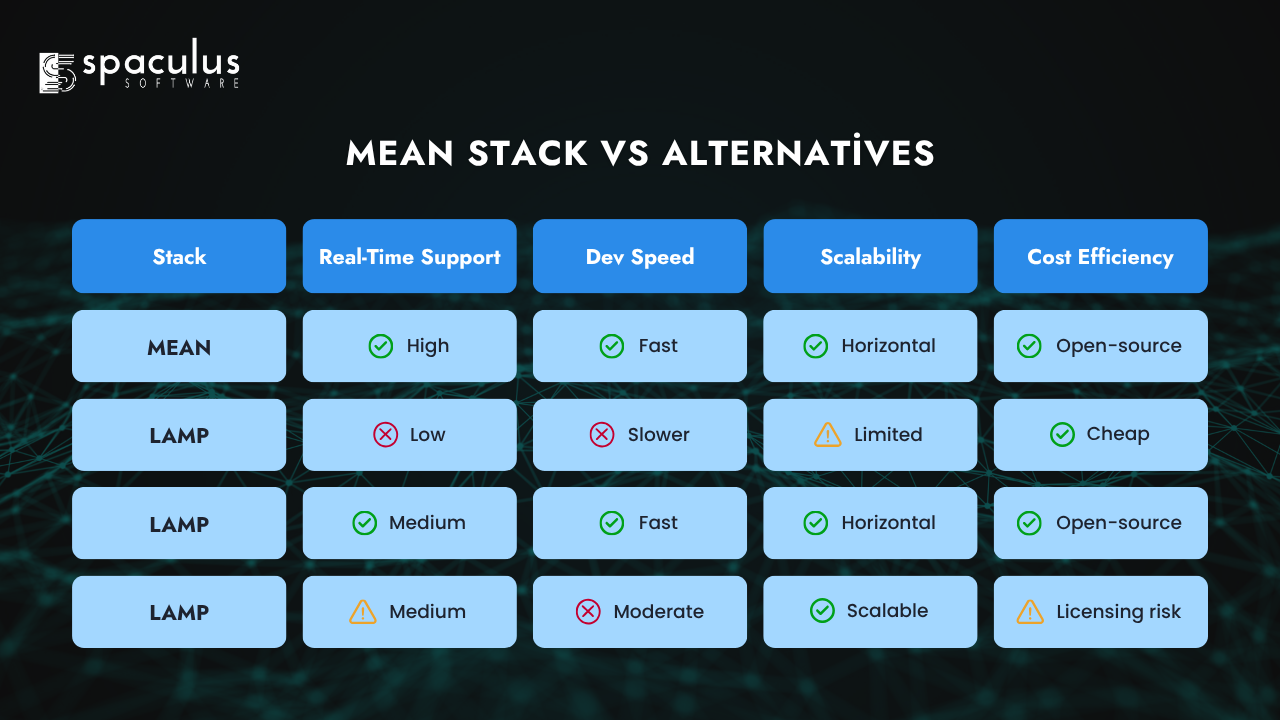

| Stack | Real-Time Support | Dev Speed | Scalability | Cost Efficiency |

| MEAN | ✅ High | ✅ Fast | ✅ Horizontal | ✅ Open-source |

| LAMP | ❌ Low | ❌ Slower | ⚠️ Limited | ✅ Cheap |

| MERN (React) | ✅ Medium | ✅ Fast | ✅ Horizontal | ✅ Open-source |

| Django | ⚠️ Medium | ❌ Moderate | ✅ Scalable | ⚠️ Licensing risk |

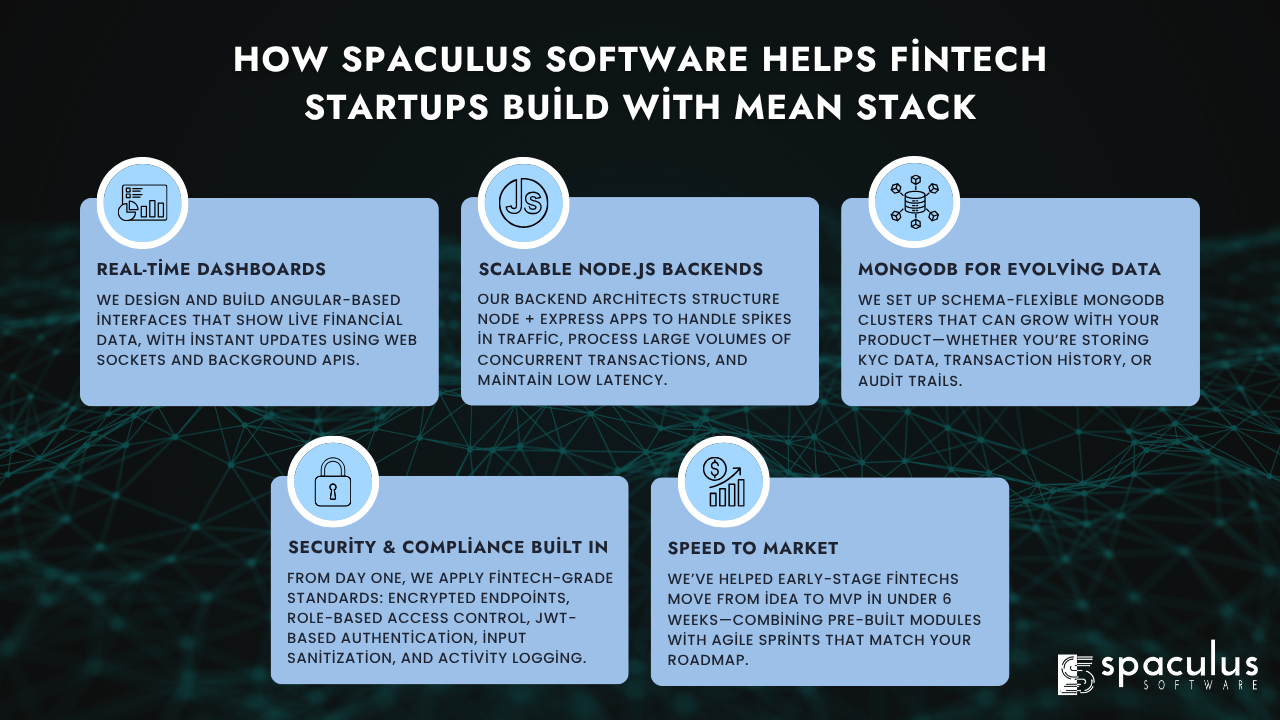

How Spaculus Software Helps Fintech Startups Build with MEAN Stack

At Spaculus Software, we don’t just write code—we help fintech startups build systems that scale, stay secure, and launch fast.

Our MEAN stack development services are tailored specifically for high-demand use cases like:

✅ Real-Time Dashboards

We design and build Angular-based interfaces that show live financial data, with instant updates using web sockets and background APIs.

✅ Scalable Node.js Backends

Our backend architects structure Node + Express apps to handle spikes in traffic, process large volumes of concurrent transactions, and maintain low latency.

✅ MongoDB for Evolving Data

We set up schema-flexible MongoDB clusters that can grow with your product—whether you’re storing KYC data, transaction history, or audit trails.

✅ Security & Compliance Built In

From day one, we apply fintech-grade standards: encrypted endpoints, role-based access control, JWT-based authentication, input sanitization, and activity logging.

✅ Speed to Market

We’ve helped early-stage fintechs move from idea to MVP in under 6 weeks—combining pre-built modules with agile sprints that match your roadmap.

If you’re building a finance app that needs to move fast but stay reliable, Spaculus can bring the technical foundation, team expertise, and execution speed you need.

Want to see what that looks like for your use case?

Reach out for a free consultation—we’ll walk through your product idea and show how MEAN stack architecture can bring it to life.

Is MEAN Stack secure enough for financial apps?

Yes. It supports all the modern security standards including:

Startups still need to implement best practices—but the stack fully supports regulatory needs like PCI-DSS and GDPR.

Can MEAN Stack scale for millions of users?

Yes. Node.js supports horizontal scaling via load balancing. MongoDB can be sharded across clusters. Angular SPAs offload frontend logic, reducing backend load.

Many fintech startups using MEAN reach 100k+ daily users with optimized infrastructure.

What if I need to add AI/ML later?

No problem. Node.js works well with AI APIs and even native models using TensorFlow.js or Python-based microservices. You can integrate fraud detection, credit scoring, or expense analysis models.

Hire mean stack Developers