Finance teams are tired.

Tired of month-end chaos, manual reports, unclear numbers, and tools that barely keep up.

But here’s what’s different now: AI is not a future buzzword anymore. It’s already changing how finance and accounting work, quietly, but deeply.

From reconciliations to forecasting, from audits to vendor checks, AI is doing more than speed things up. It’s helping people make better decisions with less stress.

This guide explains how. With examples. With real use cases. Without exaggeration.

Let’s skip the jargon.

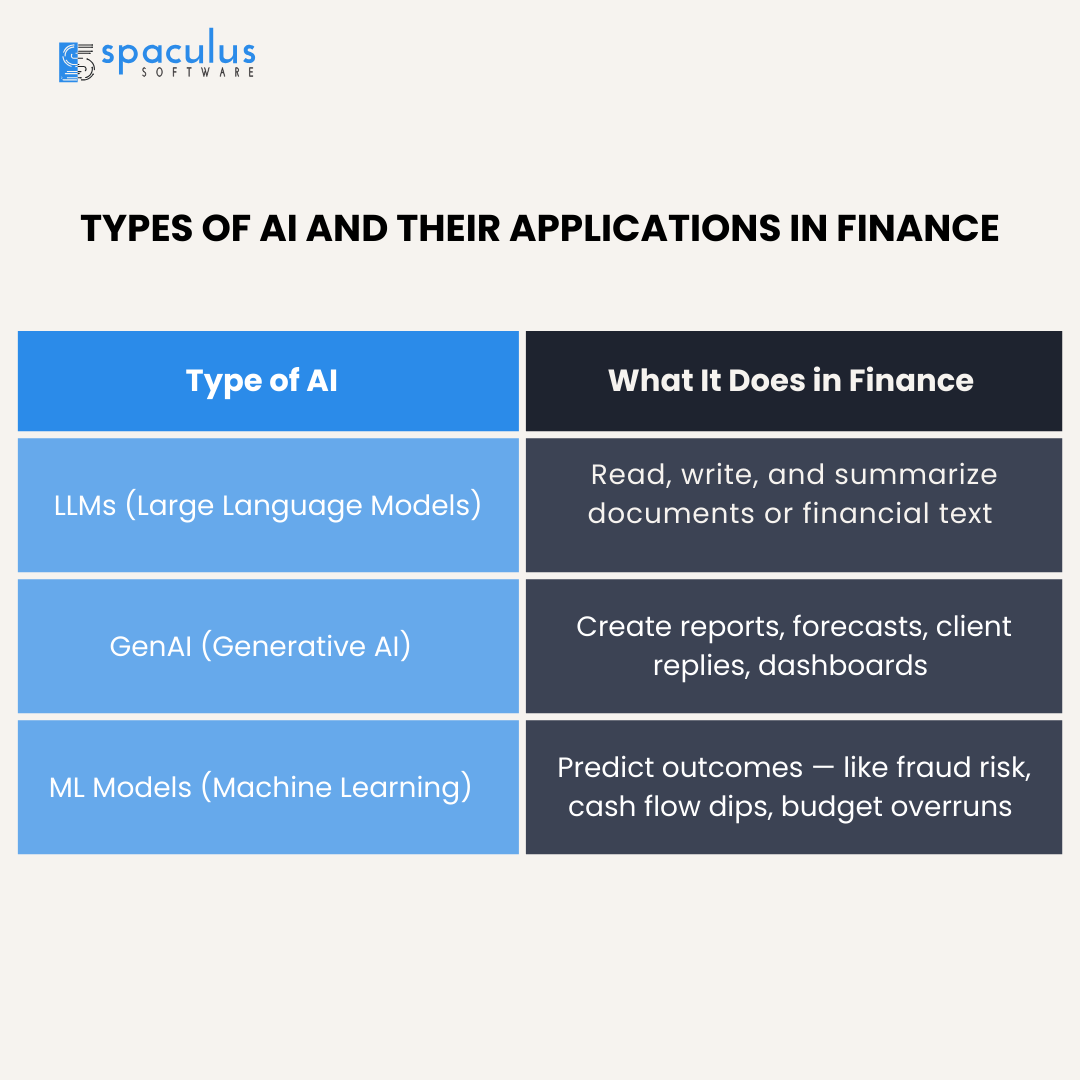

AI in this field isn’t about building robots.

It’s about giving your team smarter tools that can:

Used together, they don’t replace accountants. They support them.

Let’s be honest. Finance has always had tight processes. So why is AI a big deal now?

Here’s what’s changed:

And AI meets this moment well.

It doesn’t get tired.

It doesn’t miss a cell in row 327.

It doesn’t mind reviewing the same format 100 times.

That’s why the shift is happening.

Let’s break it down by function.

No theory — just real tasks AI is helping with:

| Function | How AI Helps |

| Bookkeeping | Auto-categorizes transactions based on past data |

| Accounts Payable | Reads invoices, matches them with POs, flags issues |

| Accounts Receivable | Predicts late payments, drafts reminder emails |

| Audit | Scans documents, highlights anomalies, prepares summaries |

| FP&A | Builds multiple forecast scenarios from raw data |

| Tax | Tracks updates in rules, suggests impact areas |

| Compliance | Monitors risky entries or patterns for review |

All of this can be done with oversight. The human still makes the final call.

These are not futuristic. They’re already used by real teams:

These are small changes, but they free up time, reduce mistakes, and let people think more clearly.

Here’s a side-by-side look to show how things actually change:

| Task | Before AI | After AI |

| Report Drafting | Manually copy-paste from Excel | GenAI builds first draft |

| Reconciliations | Spreadsheet-based checks | LLM scans and suggests matches |

| Audit Trail Review | Hours of document reading | Key issues auto-highlighted |

| Budget Planning | Manual version comparisons | Scenario simulations generated |

Again: not full automation. But a smart first pass, reviewed by humans.

When people talk about AI ROI, they often jump to “cost saving.”

But the better way to see ROI in finance is this:

| What Improves | How It Helps |

| Time to Close Books | Faster wrap-up. Fewer errors. |

| Data Visibility | Cleaner dashboards. Fewer blind spots. |

| Team Productivity | Less repetitive work. More strategic time. |

| Client Experience | Better response speed. More value in conversations. |

One client saved 12+ hours/month just by letting AI draft monthly finance memos.

That’s not huge, but over a year, it’s a full extra week of work saved. Without hiring anyone.

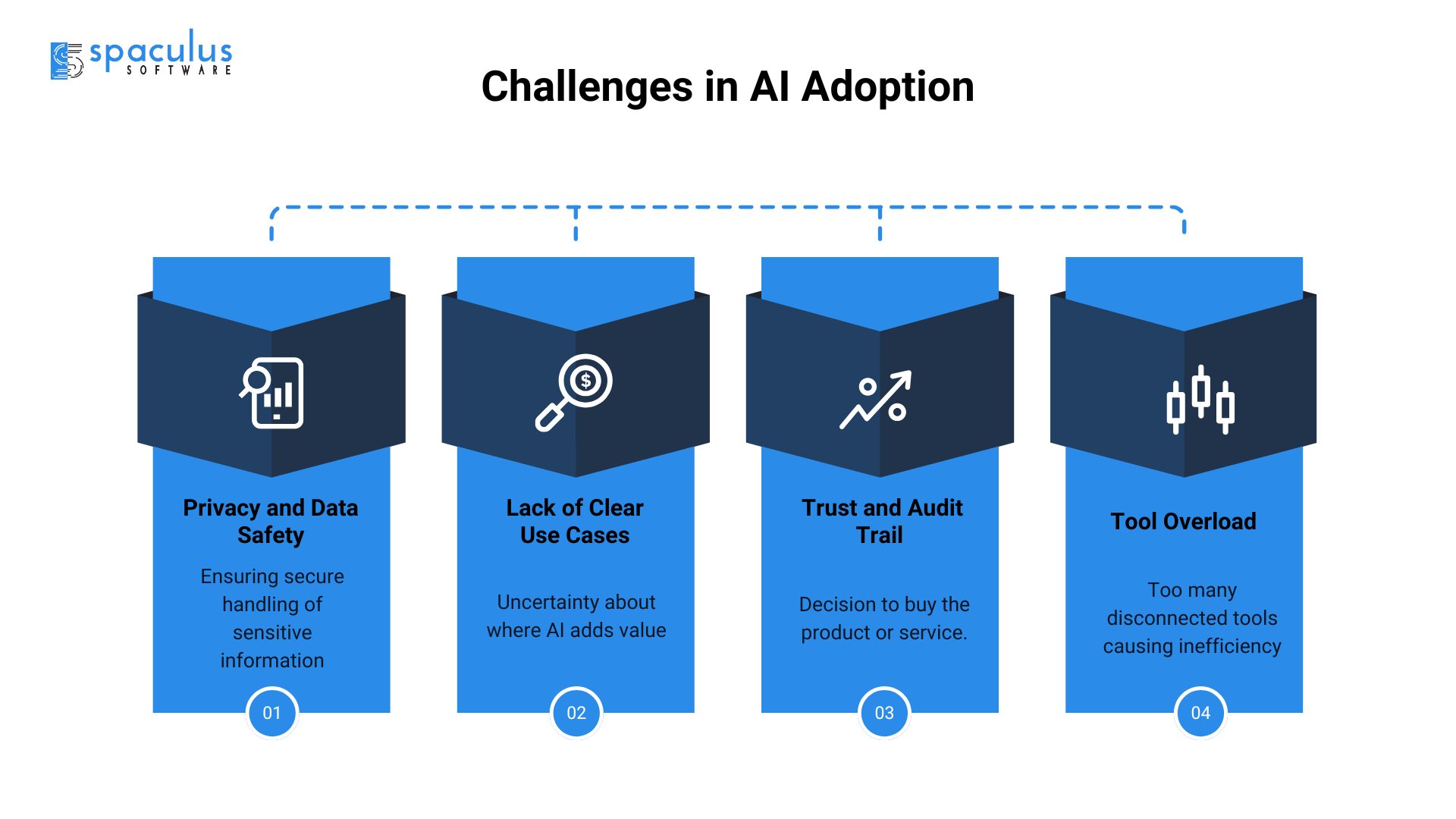

Not everyone jumps in quickly. And for good reason.

Here are common blockers:

These are all valid.

And the answer is usually:

Start small. Keep it internal. Use AI as draft support, not final say. Track everything.

Once teams see real impact, trust builds naturally.

No, not if you adapt.

AI might reduce data-entry jobs. But it also raises the value of judgment, ethics, interpretation, and communication.

Think of it this way:

People who learn how to use AI will rise faster.

People who wait too long may feel stuck.

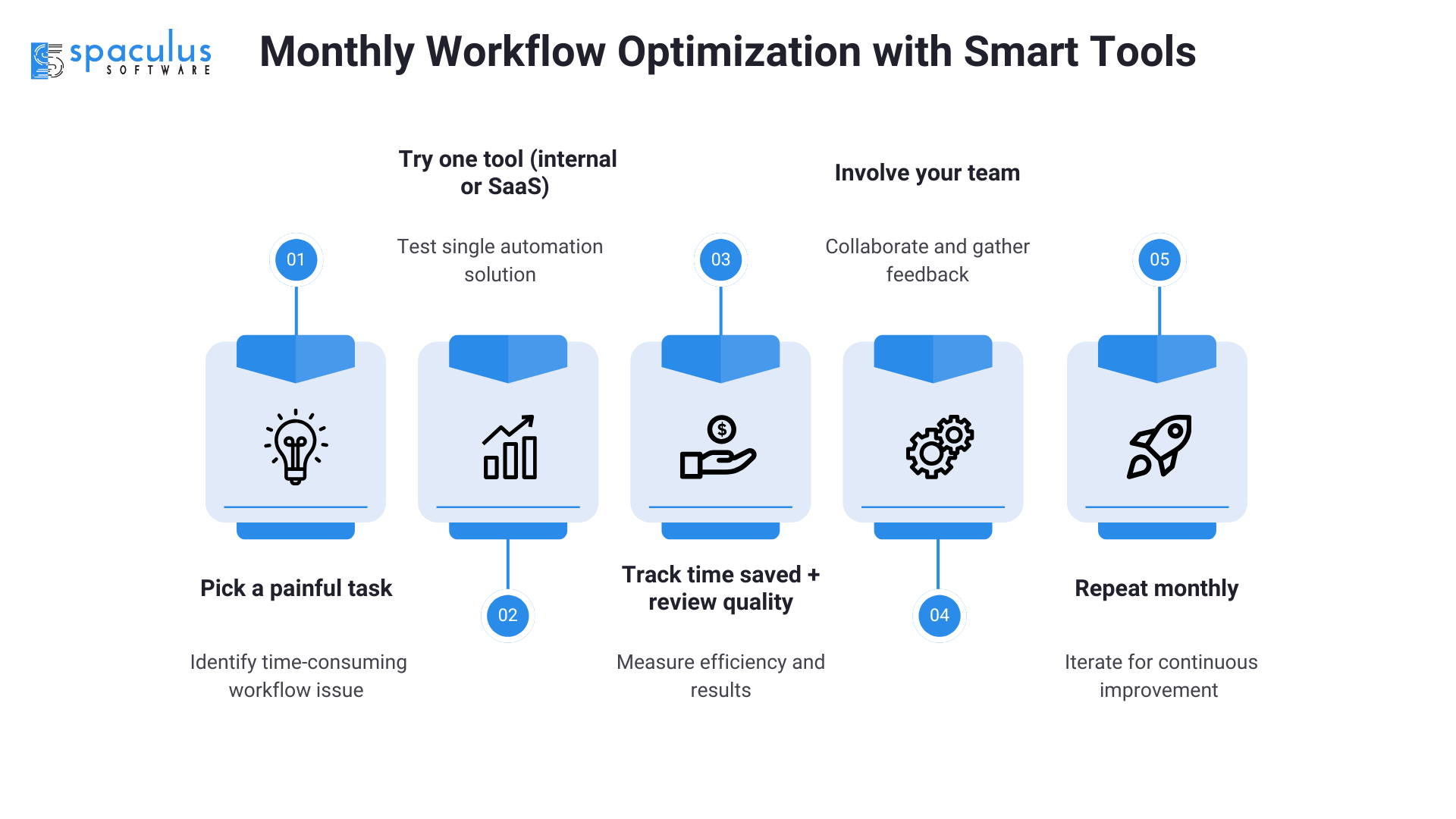

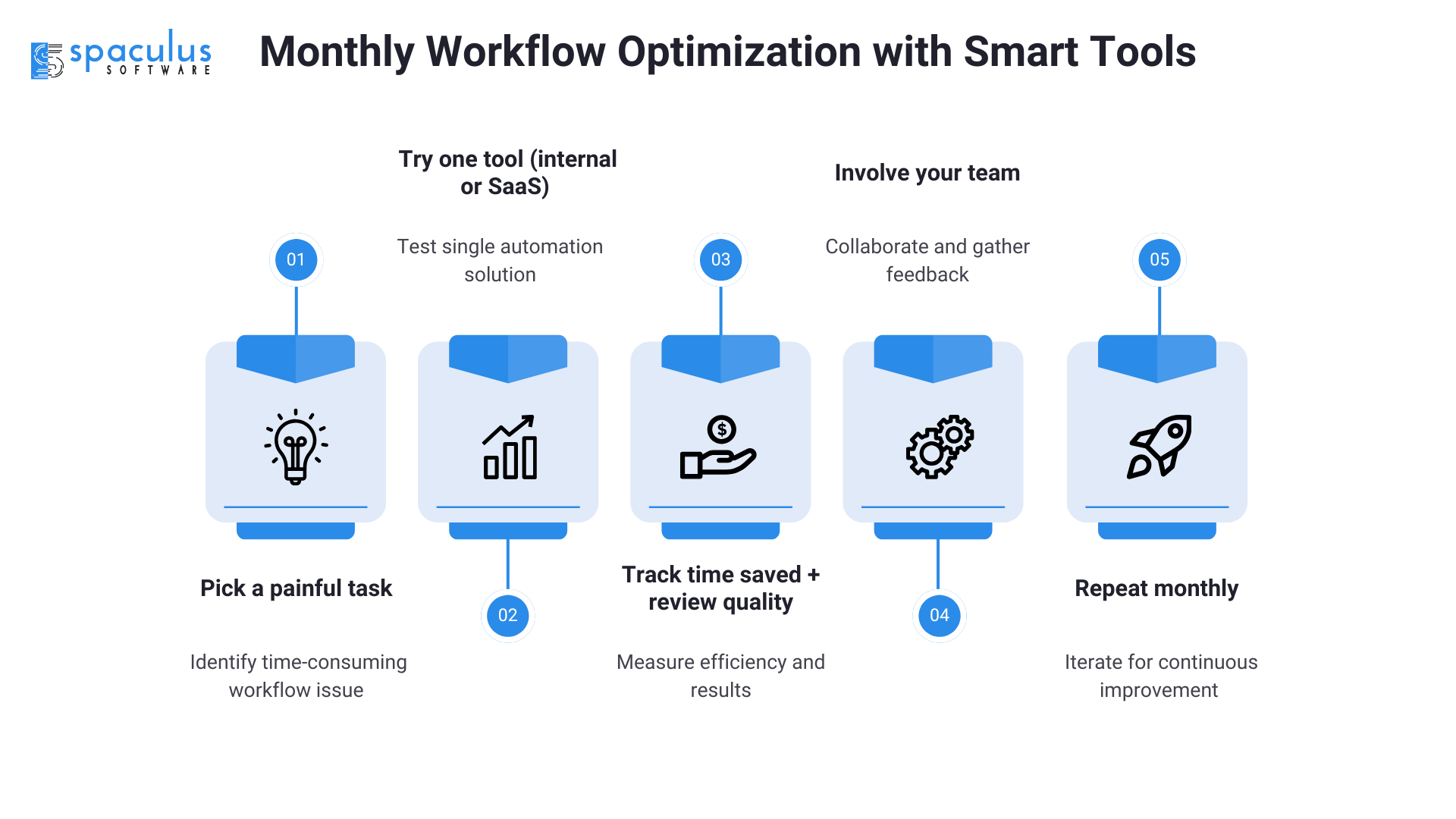

You don’t need a full rollout.

Start with one use case. Low risk. High effort today.

Here’s how:

Important: Don’t make it a tech rollout.

Make it a work relief strategy.

This question is on everyone’s mind, even if they don’t say it out loud.

AI isn’t just changing tools. It’s reshaping the skills that matter most.

Here’s how the core finance skillset is evolving:

| Traditional Skill | Still Needed?  | Evolving Into… |

| Manual data entry | ❌ Fading fast | Data interpretation, system validation |

| Excel shortcuts | ✅ Yes | But with AI integration (e.g., Excel Copilot) |

| Writing reports | ✅ Still key | But now more reviewing + refining AI drafts |

| Forecasting from scratch | ❌ Rare now | Reviewing AI-generated scenarios |

| Vendor/Client communication | ✅ More important | Using GenAI for clarity + tone tuning |

This shift doesn’t make people obsolete. It just asks them to level up.

Instead of “doing” all the work, teams need to:

In short: judgment is the new gold.

And the teams who grow into these roles will stay way ahead of the curve.

Many people ask: “This sounds great, but where do I even find these tools?”

Here’s a breakdown of what’s commonly used right now:

| Task Area | Popular AI Tools |

| Document summarization | GPT-based tools, Kira, ThoughtTrace |

| Invoice processing | Stampli, Bill.com, Vic.ai |

| Forecasting & planning | Pigment, Jirav, Datarails |

| Reconciliation | BlackLine, FloQast, MindBridge |

| Report writing | ChatGPT (custom trained), Microsoft Copilot |

| Audit trail | MindBridge, AuditBoard AI Assist |

These aren’t plug-and-play for everyone, but many have free trials or integrations with existing systems like QuickBooks, SAP, or Oracle.

💡 Pro Tip:

Start with tools that fit your current stack, not ones that force a new one.

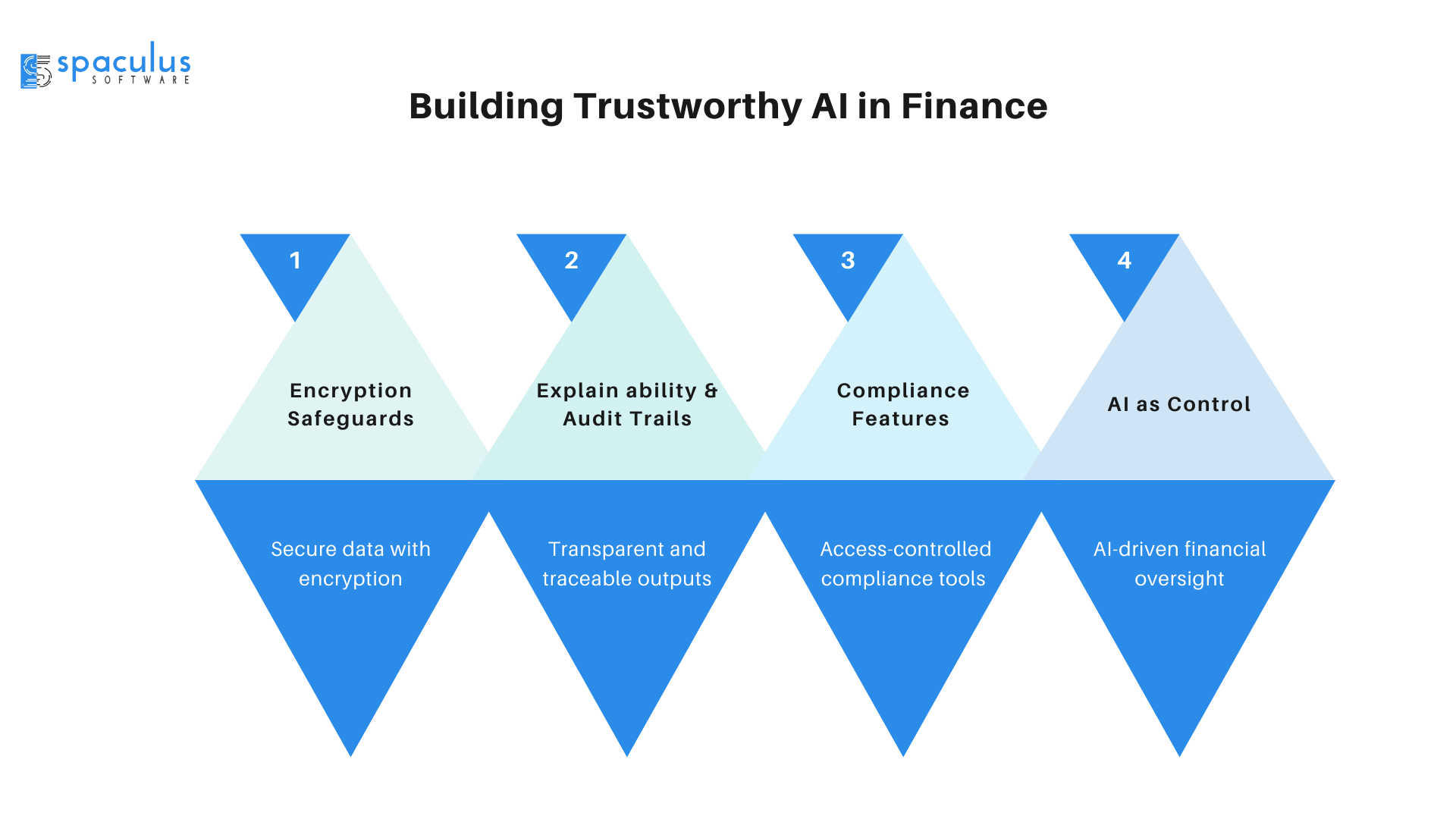

This is where many decision-makers get nervous. Rightfully so.

Finance = sensitive data.

And AI = powerful but also a black box, if not handled right.

Here’s what firms need to check before going all-in:

Data Privacy

Regulatory Alignment

Examples of Compliance Features to Look For:

| Feature | Why It Matters |

| Version control | So you can track changes in AI-generated content |

| User access logs | To see who triggered what actions |

| Role-based permissions | So only approved staff use AI tools |

Bottom line:

You don’t need to fear AI.

You just need to treat it like any financial control, with clear boundaries, monitoring, and transparency.

When done right, it’s as safe as any other digital system in your workflow.

Here’s where things are heading, practically:

These shifts won’t be overnight.

But firms already testing them are seeing better focus, less burnout, and smoother teamwork.

AI won’t change the heart of finance, but it will reshape how it’s done.

If you’re still using the same methods from 2015, you’ll start feeling the pressure.

But you don’t need a revolution. You just need a better first draft.

Let AI do the reading, matching, and drafting.

You stay in control, reviewing, thinking, deciding.

This isn’t about replacing you.

It’s about giving you space to focus on what actually matters.